37+ Total debt to equity ratio calculator

DebtEquity DE Ratio calculated by dividing a companys total liabilities by its stockholders equity is a debt ratio used to measure a companys financial. There is in depth.

Advances In Ecr Charge Breeders Advances With Electron

Therefore this companys debt equity ratio is 25.

. Use our online debt to equity ratio calculator by. Debt equity ratio Total liabilities Total shareholders equity 160000 640000 ¼ 025. The Debt to Equity Ratio Calculator calculates the debt to equity ratio of a company instantly.

Apply Today Payoff Your Debt. Comparing DEs for FY 2017 For example at the end of FY 2017 General Motors had a debt-to-equity ratio of 503far higher than Apples. The debt to equity ratio DE is calculated by dividing the total debt balance by the total equity balance as shown below.

Simply enter in the companys total debt and total equity and click on the calculate button to. Assuming that this formula is always calculated in the same way. Debt to equity ratio 570-100-8 750 100 052.

Debt to equity ratio is a method of measuring a firms financial leverage evaluated by total liabilities divided with shareholders equities. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. In a normal situation a ratio of 21 is.

The formula for debt to equity ratio can be derived by using the following steps. Its close cousin the debt-to-asset ratio uses total assets as the denominator but a DE ratio relies on. Debt to Equity Ratio Definition.

Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. For company A we obtain. Debt to equity DE ratio for a company with a total liability of 360000 and total.

So the debt to equity of Youth Company is 025. This is an online debt to equity ratio calculatorThe debt-to-equity ratio DE is a financial ratio indicating the relative proportion of shareholders equity and debt. Equity multiplier 300000 100000 30 times.

The debt-to-equity ratio is. Debt to Equity Ratio Calculator. DEBT TO EQUITY TOTAL LIABILITIES TOTAL EQUITY.

The higher the debt ratio of an organization the greater its dependence on third parties. Stockholders equity this indicator is determined by subtracting liabilities from the total of a companys assets and represents the companys book value. Do Your Investments Align with Your Goals.

This results in a debt ratio of 52. The Debt to Equity Ratio Calculator is used to calculate the debt-to-equity ratio DE. Debt Equity Ratio Total Debt Total Equity.

A company has total debt of 5000 and total equity of 2000. In Year 1 for instance the DE ratio comes out to 07x. How to calculate the debt.

A ratio that calculates total and financial liability weight against total shareholder equity. This equity ratio calculator estimates the proportion of ownersshareholders equity against the total assets of a company showing its long term solvency position. Ad Compare Best Debt Consolidation Loans Companies 2022.

The greater the equity multiplier the higher the amount of leverage. Formulas to Calculate Debt to Equity Ratio. Total equity is the is the value left in the company after subtracting total liabilities from total assets.

Firstly calculate the total liabilities of the company by summing up all the liabilities which is. How to calculate your debt-to-income ratio. The debt to equity ratio usually abbreviated as DE is a financial ratio.

To calculate your DTI for a mortgage add up your minimum monthly debt payments then divide the total by your gross monthly income. Find a Dedicated Financial Advisor Now.

How To Calculate Vegan Macros Simple Guide To Hit Your Body Goals Faster

Pin On Macros

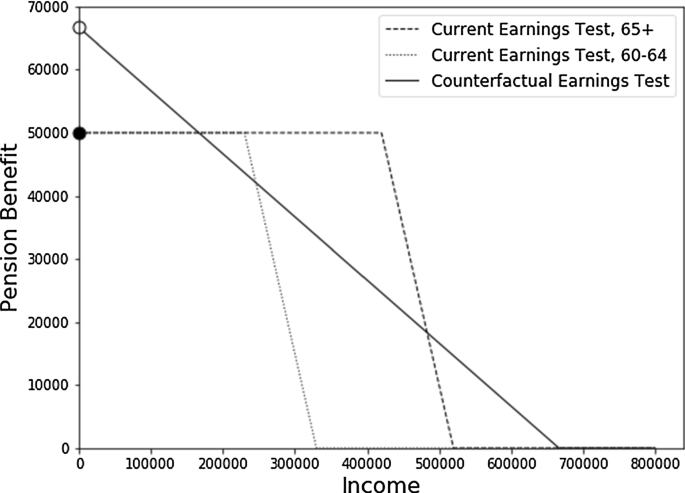

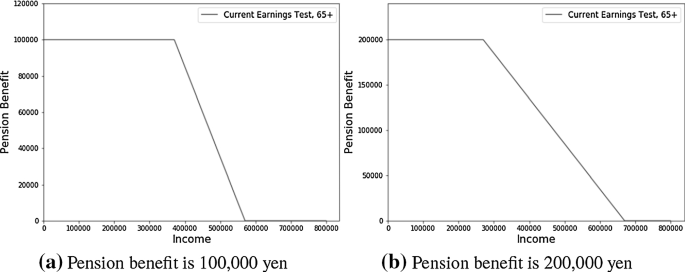

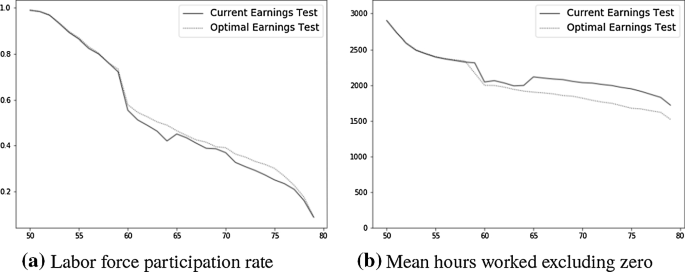

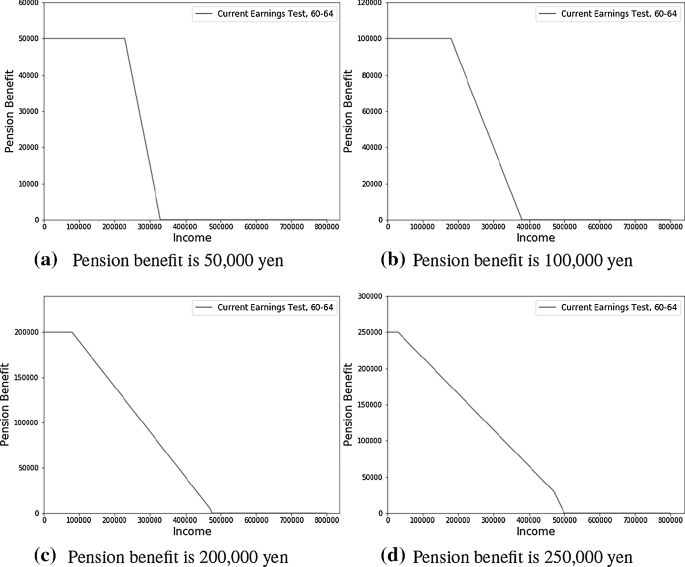

The Optimal Earnings Test And Retirement Behavior Springerlink

Balance Sheet Template Download Excel Worksheet Balance Sheet Balance Sheet Template Fixed Asset

Too Much Oil How A Barrel Came To Be Worth Less Than Nothing The New York Times

Rbse Solutions For Class 12 Accountancy Chapter 11 Ratio Analysis Https Www Rbsesolution Financial Statement Analysis Accounting Principles Learn Accounting

The Optimal Earnings Test And Retirement Behavior Springerlink

23 Email Marketing Statistics To Know In 2020 Startup Business Plan Marketing Statistics Business And Economics

Advances In Ecr Charge Breeders Advances With Electron

The Optimal Earnings Test And Retirement Behavior Springerlink

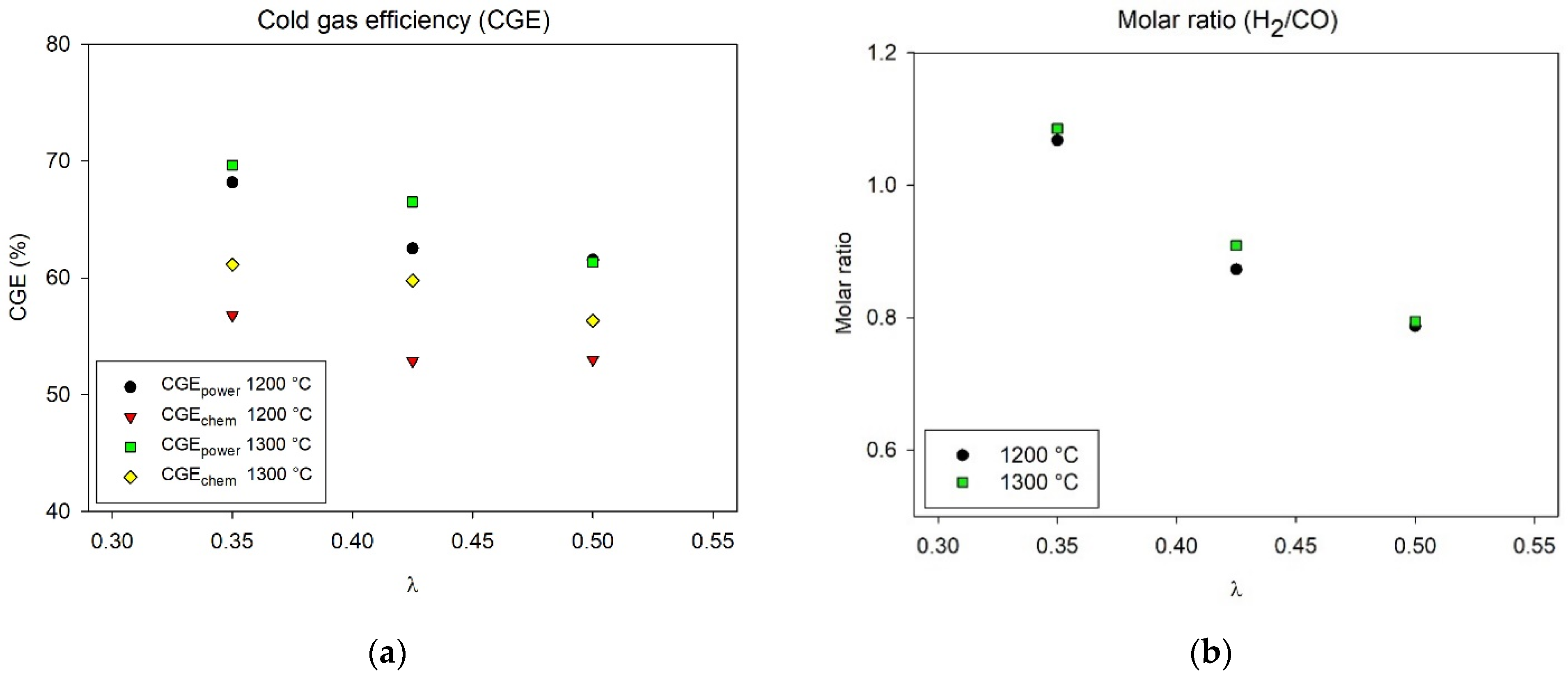

Molecules Free Full Text Entrained Flow Gasification Of Polypropylene Pyrolysis Oil Html

How Much Should You Save 50 20 30 Rule

Advances In Ecr Charge Breeders Advances With Electron

This Article Explains The Amortization Calculation Formula With A Simple Example And A Web Based Ca Home Equity Loan Home Equity Loan Calculator Mortgage Loans

The Optimal Earnings Test And Retirement Behavior Springerlink

Advances In Ecr Charge Breeders Advances With Electron

Molecules Free Full Text Entrained Flow Gasification Of Polypropylene Pyrolysis Oil Html